Medium-term Business Plan

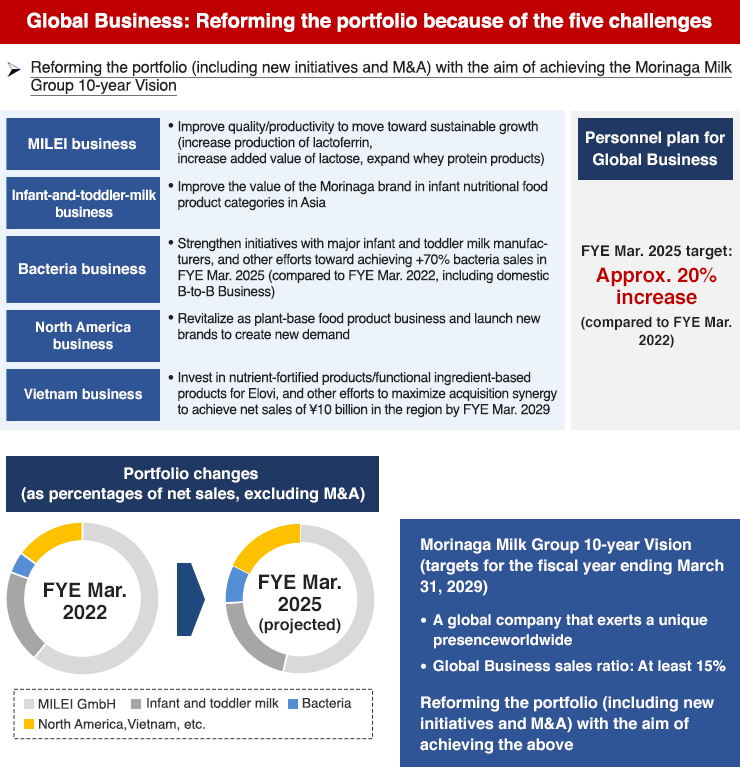

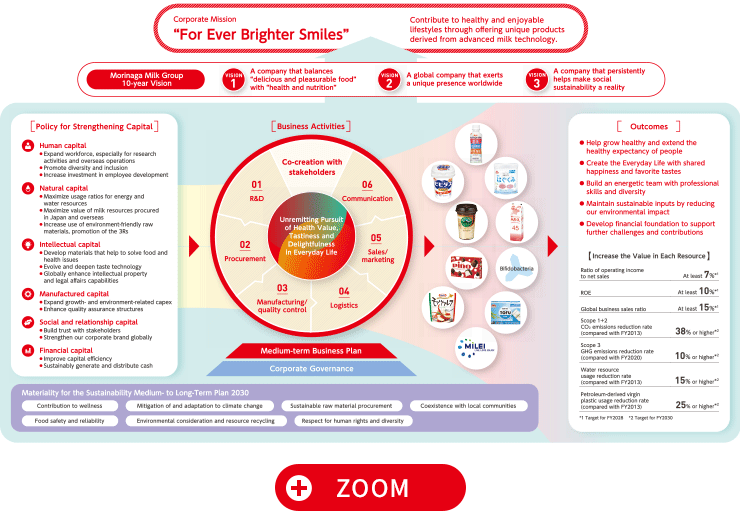

The Group established the Morinaga Milk Group 10-year Vision in April 2019, setting out its vision for the next 10 years. Under the vision, the Morinaga Milk Group sees itself one decade ahead in terms of becoming “a company that balances ‘delicious and pleasurable food’ with ‘health and nutrition’,” “a global company that exerts a unique presence worldwide,” and “a company that persistently helps make social sustainability a reality,” based on which we have established targets for the fiscal year ending March 31, 2029, aiming to achieve an “operating profit margin of at least 7%,” an “ROE of at least 10%,” and a “Global Business sales ratio of at least 15%.” The goal of the Medium-term Business Plan 2025–2028 for the four years to the fiscal year ending March 2029 is to realize the Morinaga Milk Group 10-year Vision, and to move forward with initiatives aimed one step into the future, at transforming itself into “A Clearly Differentiated and Highly Profitable Company.”

The four-year medium-term business plan starting in the FYE March 2026 will be the final phase of the Morinaga Milk Group 10-Year Vision announced in 2019. We will take another step forward to become “A Clearly Differentiated and Highly Profitable Company.”

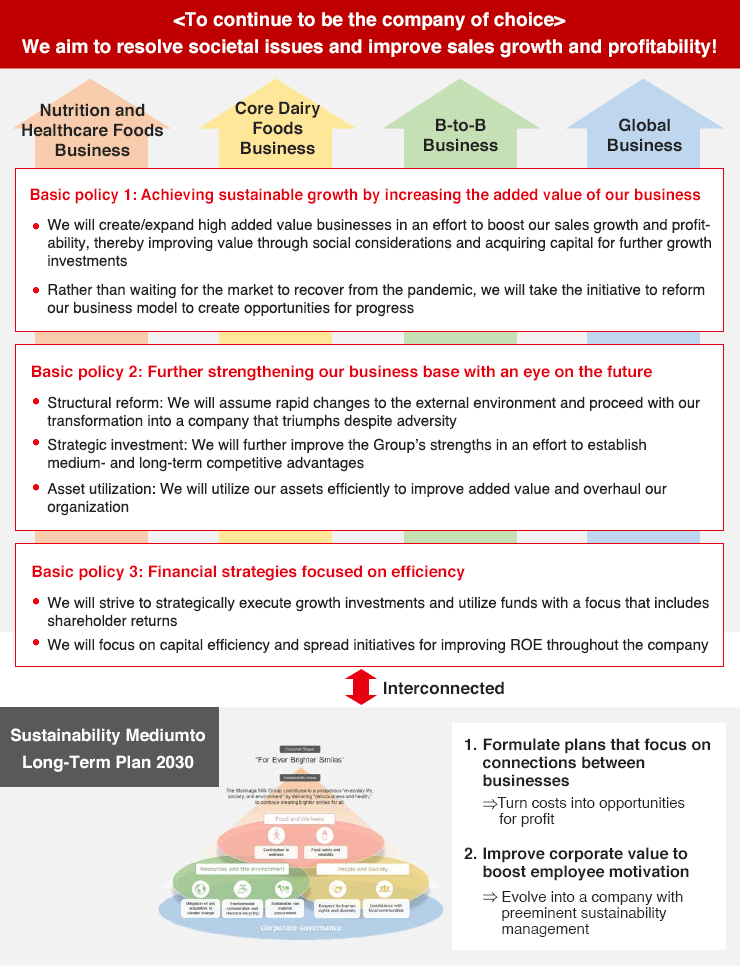

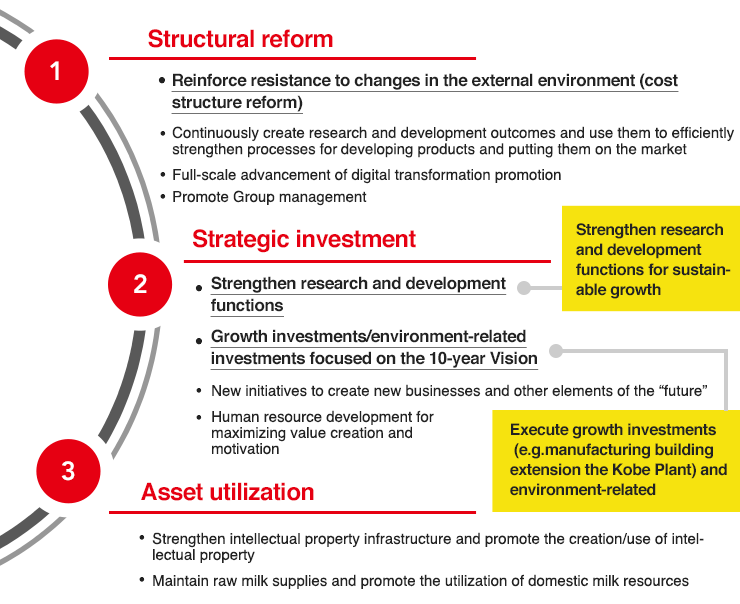

The three basic policies are “growth strategy,” “structural reforms,” and “culture reforms.”

Under “growth strategy,” we will concentrate management resources in areas where we can leverage our strengths. Under “structural reforms,” we will improve efficiency by reorganizing our organization and restructuring our production system. Under “culture reforms,” we will promote initiatives to build an energetic team with professional skills and diversity.

The key concept we emphasized in formulating this plan is “Merihari” (focus and prioritization).This is not just a concept for the four years of the medium-term business plan, but one that we want to establish within the Group over the medium to long term. This word embodies our desire to bring about change within the Morinaga Milk Group and ensure its continued growth into the future. We will review our approach, which has been directed in all directions, and allocate resources and reorganize our structure to reflect our strengths and weaknesses. At the same time, we will strive to improve productivity by ensuring that each and every employee is aware of the need for “Merihari” (focus and prioritization).

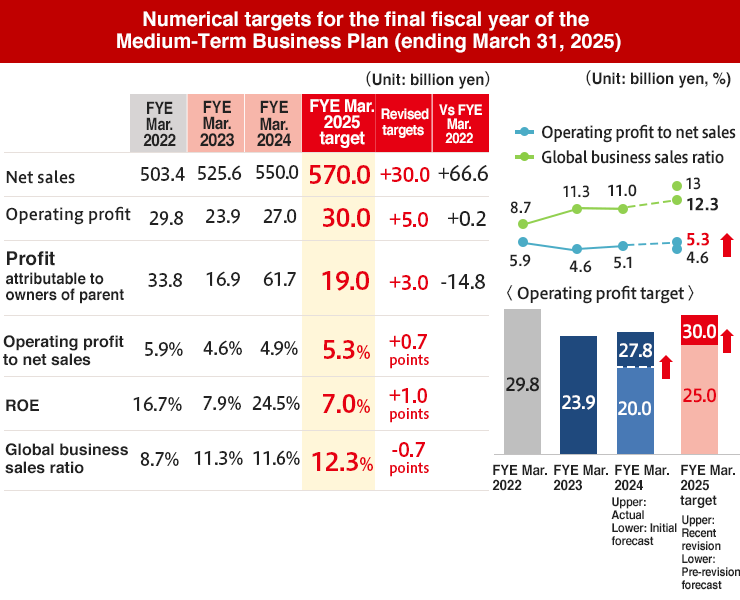

The numerical targets of the 10-year vision that we have consistently pursued since 2019 will be achieved in all areas. While these are ambitious targets, we have set them with confidence in our potential, particularly in growth areas. Additionally, in the new medium-term business plan, we have introduced a new target for ROIC across the company to enhance internal awareness of capital investment, and we have also set employee engagement ratings as a target to create a more fulfilling workplace.

The first of our basic policies is "Growth Strategy."

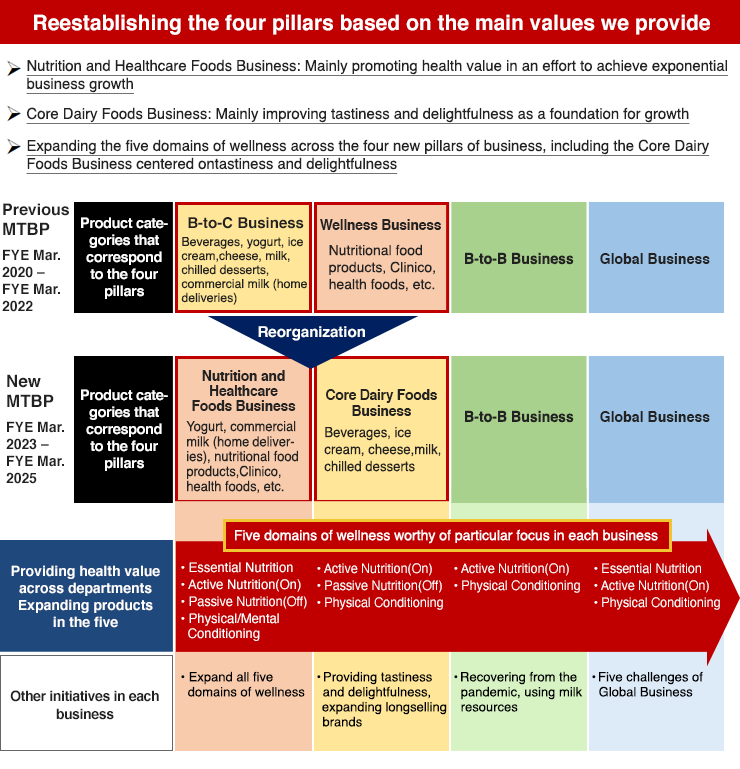

In the previous medium-term business plan, we had four business categories centered on the value we provide, but this time, we have clarified the positioning and roles of each category and changed to a system of managing categories according to their roles.

We will break away from omnidirectional thinking and position yogurt, ice cream, probiotics, and overseas formula milk as growth areas where we can maximize our strengths, and concentrate our resources on these four categories.

This shows the allocation of investment and R&D personnel.

We plan to increase investment in yogurt and ice cream, which are growth areas. We will also continue to invest in maintaining our facilities, including measures to address aging, while evaluating the effectiveness of such investments.

We will increase the allocation of R&D personnel to growth areas and aim to develop unique products and obtain new evidence for our probiotics.

This is a breakdown of net sales and operating profit by segment.

The growth areas are categories that are particularly profitable within the Group. By concentrating management resources in this area, we aim to become a company with higher profit margins.

The policies for the four growth areas are as follows.

In yogurt, we will concentrate our resources on “Bifidus” and “PARTHENO.”

“Bifidus” brand will be expanded by strengthening PR for bifidobacteria, which is our strength, and pursuing new functionalities. “PARTHENO” is a brand that has been experiencing lost opportunities due to production not keeping up with demand, and we will promote initiatives for expansion, including increasing production facilities.

In ice cream, we will take on the challenge of capturing the top share in the domestic market and expanding exports. To this end, we will develop products with a sense of speed by diversifying channel areas from the product design stage, without distinction between domestic and overseas markets, B-to-B and B-to-C.

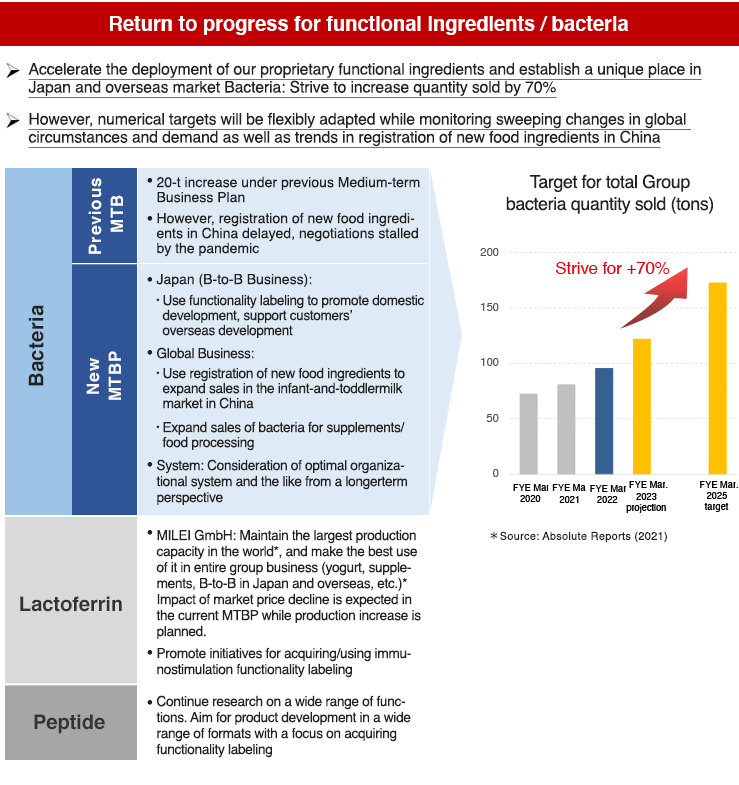

The Group handles a wide range of functional materials, but we will focus our resources on bifidobacteria, which have a unique presence in the global market, with the aim of doubling sales. To focus on probiotics, we reorganized our sales organization into a headquarters structure starting in April 2025. By breaking down domestic and international barriers and establishing a global sales structure, we will expand sales in our focus areas. Additionally, in addition to expanding new evidence and research and development of LAC-Shield®, we are also strengthening intellectual property, legal, and back-office functions, which will become increasingly important in the future.

This is formula milk for overseas markets. Formula milk is a category that is compatible with bifidobacteria.

By strengthening our research and development resources, we will accelerate product development in areas where we can leverage our early-mover advantage and expand our product lineup. Flexible marketing strategies will also be necessary to increase our target audience, so we will work to improve our cost competitiveness and expand our brand.

The second basic policy is "Structural Reforms."

First, we will reorganize our organization. We will establish Marketing Division and Functional Food Ingredients Division to serve as the command centers for our businesses, thereby improving efficiency and accelerating business growth. In addition, we will strengthen our business development capabilities in the field of probiotics by establishing a Biotics Institute, and we will improve the effectiveness of our investments by making the Financial & Accounting Division an independent division.

This is about the reorganization of our domestic production system.

During this medium-term business plan period, we will reduce our paper pack production lines by half. We have decided to construct and start operations at the Hokkaido Eniwa Plant, which is part of our investment decision to reorganize our beverage production system. In addition, we are planning to consolidate not only production lines but also production sites.

On the other hand, in the growing yogurt and ice cream categories, we are unable to keep up with demand, resulting in lost sales opportunities. We will expand our facilities in these categories.

Going forward, we will continue to monitor domestic market trends and build an optimal production structure to meet demand.

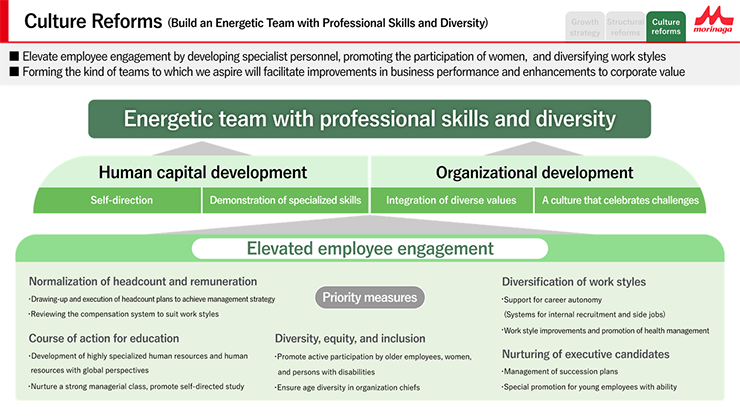

The third basic policy is "Culture Reforms."

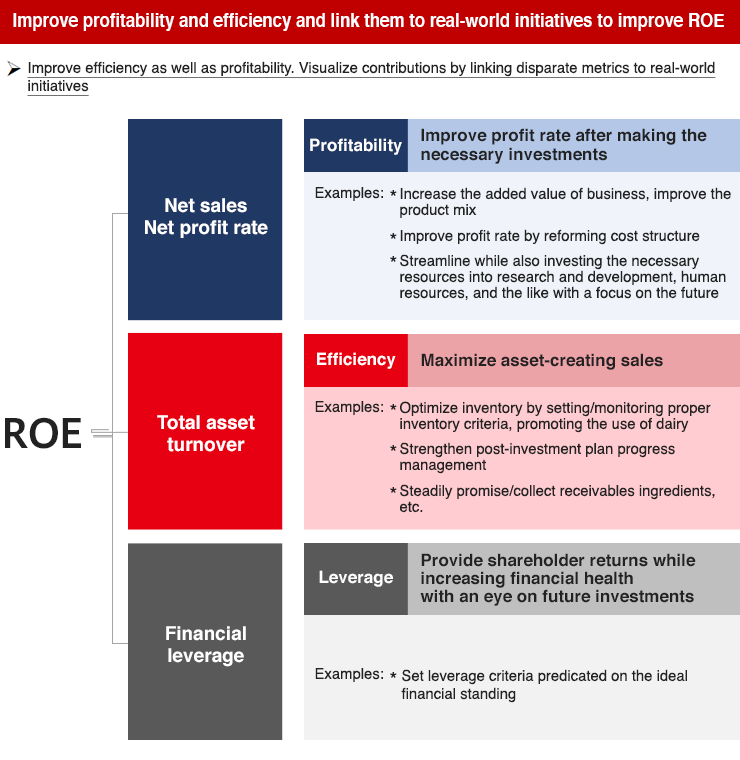

To further raise awareness of capital costs within the company and improve capital profitability, we have introduced ROIC as a new management indicator.

Over the next four years, we plan to reorganize our production system and invest in growth areas, while also working to reduce fixed costs in addition to growing our business, with the aim of improving profitability.

This is our policy on human capital.

Through measures to improve employee engagement and achieve this goal, we will aim to build an energetic team with professional skills and diversity, which is the Group's goal, and thereby enhance corporate value.

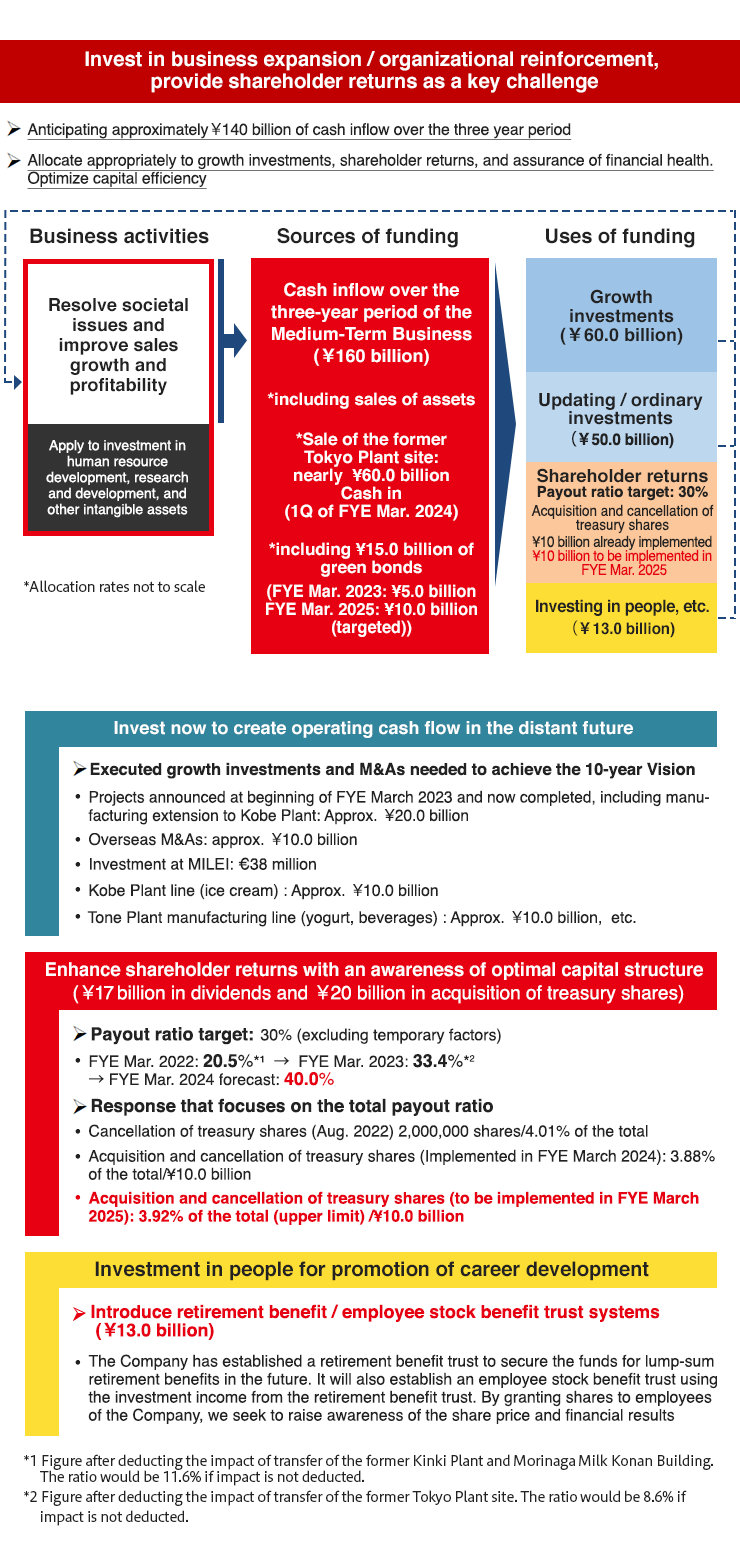

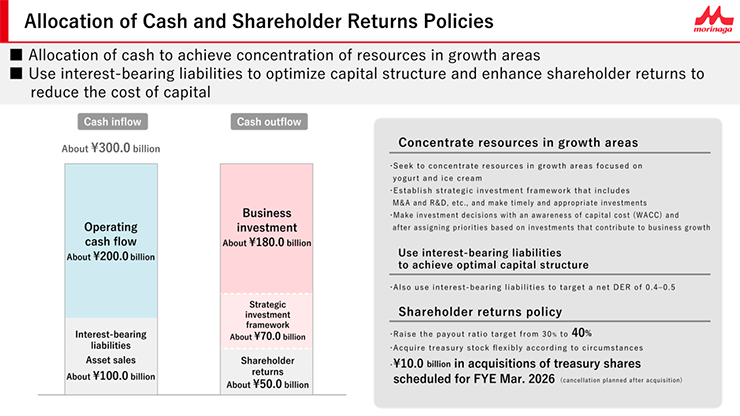

Finally, we would like to mention our cash allocation and shareholder return policy.

Our approach to cash inflows and outflows is shown in the chart above. We intend to make appropriate use of interest-bearing debt to achieve an optimal capital structure.

We have raised our target dividend payout ratio from 30% in the previous medium-term business plan to 40%. In addition, we have announced plans to acquire 10 billion yen worth of treasury stock in the fiscal year ending March 2026. Going forward, we will continue to consider flexible responses as circumstances dictate. Regarding cash outflows for investments, the actual scale may vary depending on circumstances, including strategic investment allocations.

The above summarizes our new medium-term business plan. We will strive to achieve all numerical targets of our 10-year vision and take another step forward toward our desired future state of becoming “A Clearly Differentiated and Highly Profitable Company,” while maintaining a clear focus on priorities.